E-Town Capital shines on the "2025 Investment Institutions Soft Power Rankings"

As the new generation of technological industrial revolution rises globally, the industrial environment and competitive landscape that investment institutions rely on have undergone profound restructuring. Forward-looking industry insights, clear investment strategies, and efficient exit capabilities, among other soft powers, are gradually becoming core elements for investment institutions to adapt to market changes and build new competitive advantages.

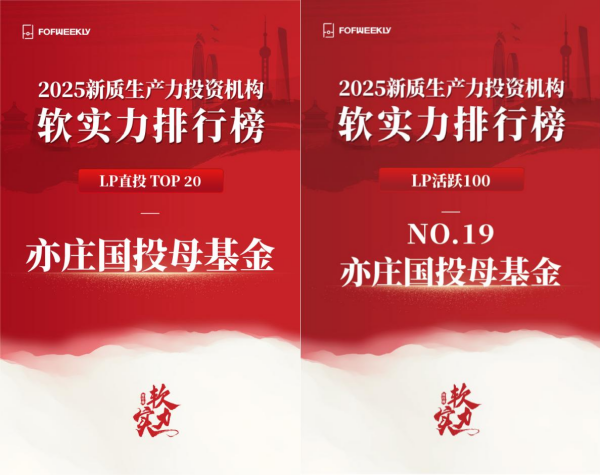

The highly anticipated FOF WEEKLY recently released the "2025 Investment Institutions Soft Power Rankings." Beijing E-Town International Investment & Development Co. (E-Town Capital)'s fund of funds (FoF) distinguished itself by winning two prestigious awards: "Top 100 Active LPs" and "Top 20 Direct Investment LPs," making it one of the few State-owned institutions in the equity investment field to win dual recognition.

As a renowned service platform for professionals in equity investment institutions, FOF WEEKLY applies the theory of soft power to the practice of equity investment, deconstructing the intrinsic drivers of long-term development for investment institutions and LPs. Upholding principles of fairness and justice, it creates the soft power rankings through comprehensive, multi-dimensional professional evaluations, promoting healthy industry development.

E-Town Capital, one of the earliest government investment institutions in China to engage in both "sub-fund + direct investment," has established a comprehensive FoF system covering angel, VC, PE, M&A funds, specialized funds, and overseas funds. With keen market insight, it captures industry trends, empowers invested enterprises with professional investment capabilities, and promotes coordinated development of production and investment through efficient resource integration. As of the end of June 2025, it managed over 90 funds with a total scale exceeding one trillion yuan.

The recognition by FOF WEEKLY highlights E-Town Capital's precise layout in the direct investment field and its active presence and influence in the capital market. It underscores the company's benchmark role and industry status in fund scale, investment effectiveness, and industrial promotion. E-Town Capital will continue to serve technological innovation and the real economy, seize current strategic investment opportunities, and strengthen the market-oriented, professional, and refined operation of its fund system. By guiding social capital to co-build an industry-finance empowerment ecosystem, it aims to support the high-quality development of strategic emerging industries and future industries, making greater contributions to advancing the construction of a modern industrial system and accelerating the development of new quality productive forces.

Print

Print Mail

Mail